If you choose to accept loan offers, you and/or your parent may need to complete additional loan requirements. All loan requirements can be completed on studentaid.gov.

Loans, even if accepted, will not disburse until all necessary loan requirements are complete. You may accept the loans now and if you change your mind, use the Financial Aid Change Request Form to cancel or reduce the loan before disbursement each semester.

Subsidized/Unsubsidized Loan

The following loan requirements must be completed by the student and only needs to be completed once. You do not need to complete this every school year.

- Direct Loan Entrance Counseling

- Direct Loan Master Promissory Note (MPN)

Parent PLUS Loan

The following loan requirements must be completed by the parent. There may be additional steps for the Parent PLUS loan if the parent borrower is initially denied. These loan requirements will need to be completed every school year.

- Parent PLUS Loan Application

- Parent PLUS Loan Master Promissory Note (MPN)

When you apply for a Direct PLUS Loan, the Department of Education will check your credit history. If you are found to have an adverse credit history, you may still borrow a Parent PLUS Loan if you get an endorser who does not have an adverse credit history or successfully appeal the adverse credit decision. An endorser is someone who agrees to repay the Parent PLUS Loan if you do not repay the loan.

If you are appealing/endorsing the PLUS loan due to adverse credit, additional PLUS counseling must be completed by you at studentaid.gov in addition to completing the credit appeal/endorse process).

Graduate PLUS Loan

The following loan requirements must be completed by the student. There may be additional steps for the Graduate PLUS loan if the student borrower is initially denied. The loan application and MPN will need to be completed every school year and the counseling only needs to be completed once.

- Grad PLUS Loan Application

- Grad PLUS Loan Master Promissory Note (MPN)

- Grad PLUS Loan Entrance Counseling

When you apply for a Direct PLUS Loan, the Department of Education will check your credit history. If you are found to have an adverse credit history, you may still borrow a Grad PLUS Loan if you get an endorser who does not have an adverse credit history or successfully appeal the adverse credit decision. An endorser is someone who agrees to repay the Grad PLUS Loan if you do not repay the loan.

If you are appealing/endorsing the PLUS loan due to adverse credit, additional PLUS counseling must be completed by you at studentaid.gov in addition to completing the credit appeal/endorse process).

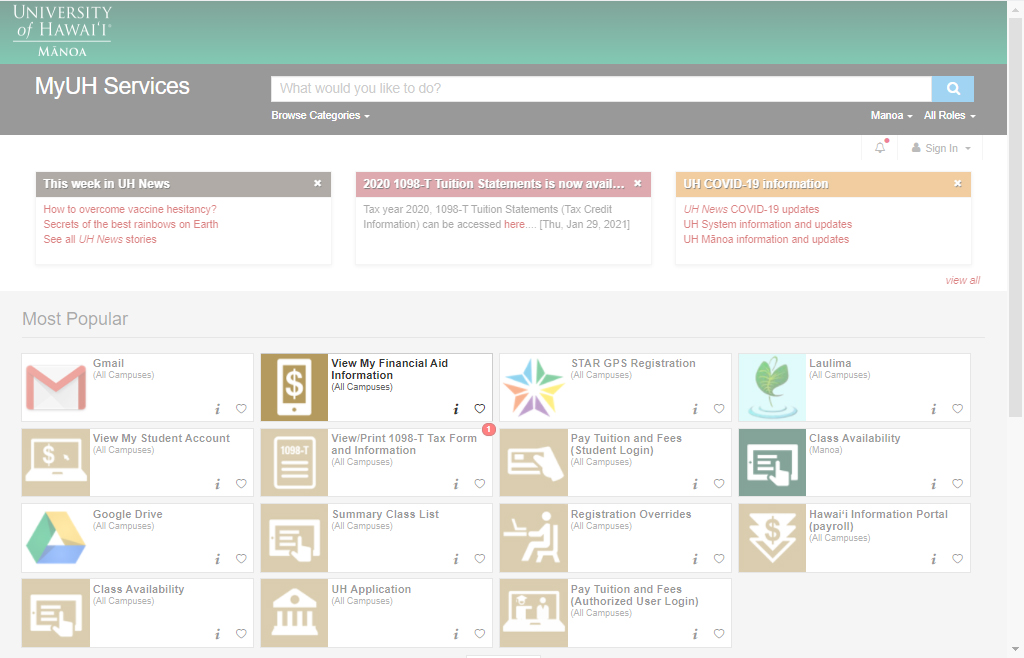

Instructions to view your loan requirements

The following screenshots are from a sample student. Your MyUH account may reflect differently.

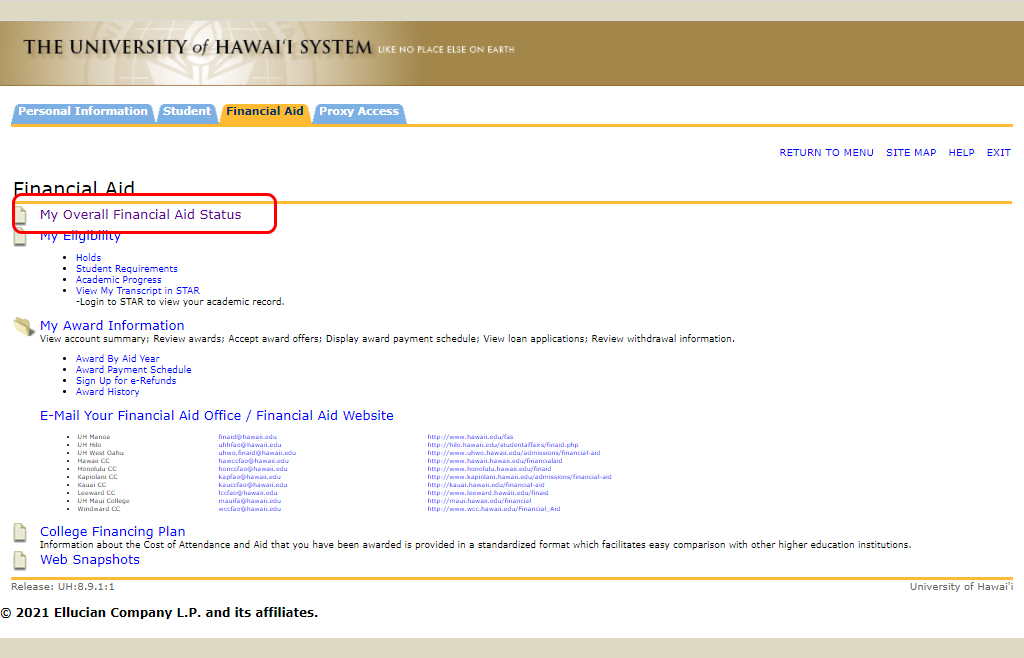

- Login to myuh.hawaii.edu

- Click on the “View My Financial Aid Information” link.

- Click on “My Overall Financial Aid Status“.

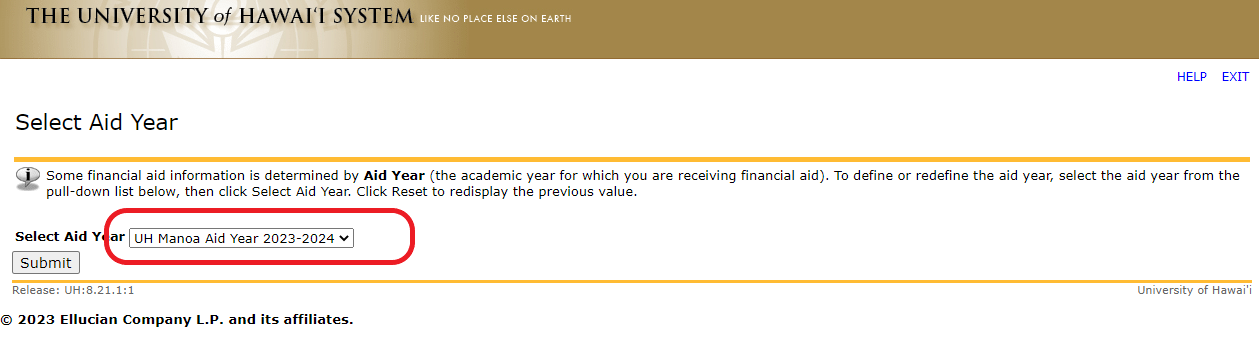

- Select your aid year. Click “Submit“.

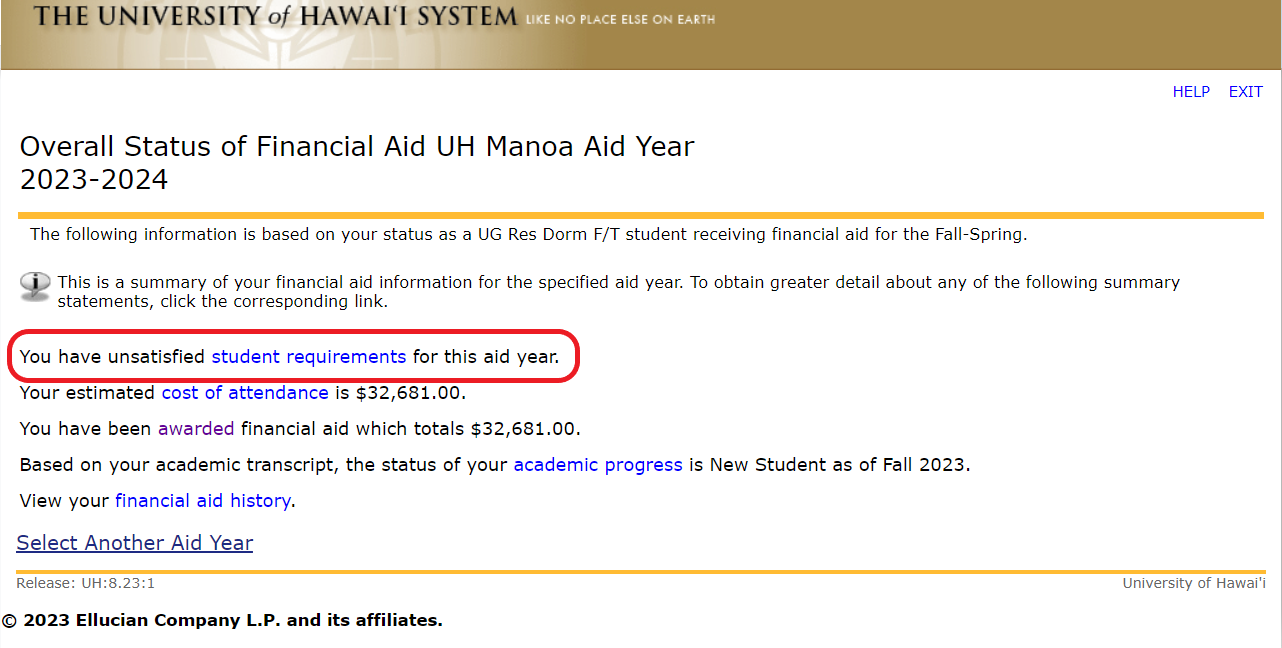

- Click on the “Student Requirements”.

- Complete the necessary requirements listed under the “Unsatisfied Requirements” section. Each loan requirement listed is hyperlinked and contains instructions for you to follow.

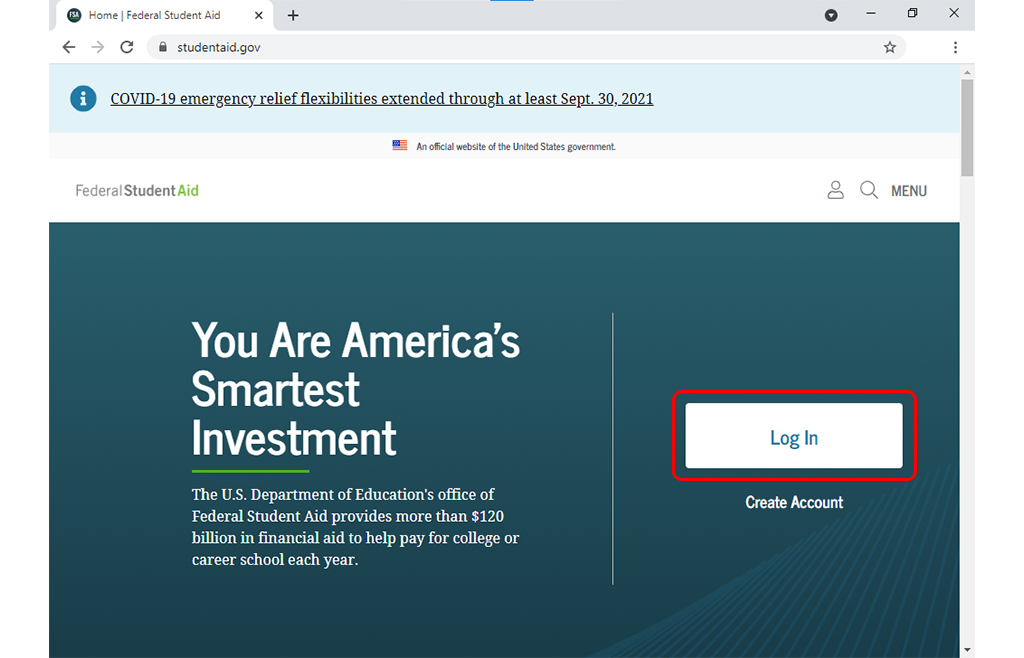

- The links will take you to studentaid.gov. Click the “Log In” button and log in with your StudentAid.gov Account.

If this is your first time using MyUH Services, click on www.hawaii.edu/username/

**Notices/Aid information will NOT be mailed. All communication is sent through MyUH Services/via email.**

Location of the Financial Aid link may not be the same on your page.